missouri employer payroll tax calculator

Employer Withholding Tax - Missouri The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated. Missouri Salary Paycheck Calculator.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

That tax rate hasnt changed since 1993.

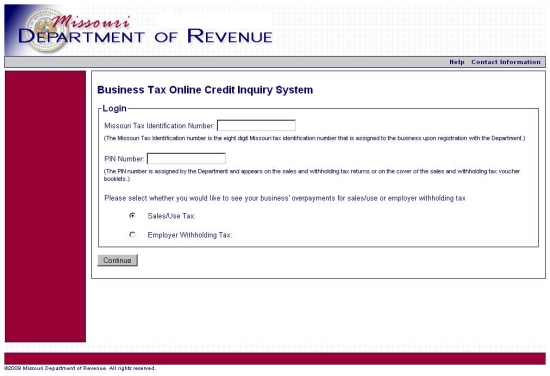

. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Paycheck calculators Payroll tax rates Withholding forms Small business guides. If you have misplaced this identification number and are an authorized person for the account you may call 573 751-5860 to obtain.

Missouri Payroll for Employers. Brush up your resume sign up for training and create an online profile with. Missouri is currently not a credit reduction state.

Below are your Missouri salary paycheck results. Missouri Hourly Paycheck Calculator Results. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Its a progressive income tax meaning the more. Employers covered by Missouris wage payment law must pay wages at least semi-monthly. Use ADPs Missouri Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Employers covered by the states approved UI program are required to pay 60 on wages up to 7000 per worker per year to the Federal UI. The results are broken up into three sections.

Paycheck Results is your gross pay and. Just enter the wages tax withholdings and other information required. Paycheck Withholding Calculator Statement of Account.

Follow the steps on our Federal paycheck calculator to work out your income tax in Missouri. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Missouri Tax Registration Application Form 2643. So the tax year 2022 will start from July 01 2021 to June 30 2022. If you work for yourself you need to pay the self-employment tax which is equal to both the.

Employer tax in Georgia employee tax. The standard FUTA tax rate is 6 so your. Missouri Hourly Paycheck Calculator.

The maximum an employee will pay in 2022 is 911400. The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15. Employees with multiple employers may refer.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Missouri has the lowest cigarette tax of any state in the country at just 17 cents per pack of 20. The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated.

Missouri Cigarette Tax. All corporations and manufacturers doing business in the state.

Missouri Paycheck Calculator Smartasset

Where S My Refund Missouri H R Block

Withholding Tax Credit Inquiry Instructions

Payroll Tax Calculator For Employers Gusto

Local Income Tax What Employers Need To Know Workest

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Trump S Proposed Payroll Tax Elimination Itep

Missouri Payroll Tools Tax Rates And Resources Paycheckcity

The Employer S Payroll Question And Answer Book 2021 Love Paul E 9798587839045 Amazon Com Books

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Salary Paycheck Calculator Calculate Net Income Adp

1099 Tax Calculator How Much Will I Owe

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Relief In Employment Tax Cases With The Irs Silver Law Plc

Working From Home During The Pandemic Doesn T Include Tax Breaks Stlpr