how to file taxes if you're a nanny

Pay Your Nannys Salary. That means you file taxes the same way as any other employed person.

The Differences Between A Nanny And A Babysitter

Easy Tax Preparation Management.

. Collect your W-2 from your employer Your employer should provide you with a few W-2s. However youll still need to pay this tax on wages. Maximize Your Tax Refund.

If youre a nanny who cares for children in your employers home youre likely an employee. Copies B C and 2. Parents will need to file Schedule H with their own federal income tax return which reports Social Security Medicare unemployment tax and any income tax withheld from their.

Taxes Paid Filed - 100 Guarantee. Descubra vídeos curtos sobre taxes for nanny no TikTok. Know youre an employee not an independent contractor.

We find evidence of pervasive noncompliance. Ac-cording to our estimates only 53 percent of household employers file. I am a nanny how do I pay my taxes.

Ad Nanny Household Tax and Payroll Service. Taxes Paid Filed - 100 Guarantee. Ad Easy To Run Payroll Get Set Up Running in Minutes.

For the Nanny Step 1. You will use this form to file your. CPA Professional Review.

Do this by submitting Schedule H which calculates the federal employment taxes on. File Copy A of Form W-2 and Form W-3 with the Social Security Administration by. If you part ways after a year you still.

Apply for one online. Download and fill out Form. Ad Prevent Tax Liens From Being Imposed On You.

If youre a nanny or other worker who cares for others children in their employers home and you have specific job duties assigned to you the IRS considers you a household. Ad Easy To Run Payroll Get Set Up Running in Minutes. Ad Nanny Household Tax and Payroll Service.

If you determine you have a household payroll you must report the income paid on your tax return. You need to prepare a Schedule H and file it with your federal income tax return. What you need to do when you take on any caregiving or household job.

If you make 2400 or more from a family the family. Ad Ideal For Busy Families and Budgets. Your state may also require an Annual Reconciliation form which summarizes the state income taxes you.

CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations. Fail to comply with their Federal Nanny Tax obligations. At tax time youll need to file a Form W-2 reporting your household employees income earned and withholdings and Form W-3 Transmittal of Wage and Tax Statements with.

You may owe state unemployment taxes SUI Do not count wages if your nanny is a spouse your child under age 21 or parent. To file quarterly utilize this structure to estimate representative federal annual tax manager and. This form will show your wages and any taxes withheld.

Its worth knowing that the standard 153 FICApayroll taxes only apply if your nanny pay is more than 2000 in the. Your nanny fills out the Form I-9 and you keep it on file for three years after you hired her or one year after she stops working for you. Revealing and Filing Taxes.

Prepare and distribute Form W-2 to your employees by January 31 for the previous years taxes and wages. Your employer is required to give you a form W2 by January 31st. How to Classify Your Nanny Pay and Household Worker Status.

Nanny Tax Example. If youre calculating nanny taxes on your own add up the taxes due for the quarter log into your EFTPS account make the payment and record the date and amount of the. Nanny Megthe_nannymeg Tax Professional EA dukelovestaxes.

Your nanny should fill out an I-9 a federal W-4 form PDF and a state withholding form if your state collects income tax. Assista a conteúdos populares dos seguintes criadores. CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations.

The Tax Implications Of Having A Nanny Or Housekeeper The Turbotax Blog

How To Claim Nanny On Taxes Canada Ictsd Org

5 Financial Tips For Millennials Mark J Kohler Tax Legal Tip Youtube Kohler Financial Tips Nanny Tax

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Nannies What Are Your Legal Responsibilities When Employing A Live Out Nanny Babycenter Canada

Do I Need To Pay Taxes For My Nanny

How Does A Nanny File Taxes As An Independent Contractor

Babysitting Tax In Canada What You Need To Know

7 Steps For Filing Taxes As A Nanny Or Caregiver Writing A Business Plan Business Planning Business Inspiration

How To Easily Complete Taxes For Your Nanny By Nate Nielsen Medium

Nanny Payroll Part 3 Unemployment Taxes

8 Tax Benefits All Work At Home Moms Should Know About Work From Home Moms Tax Tax Refund

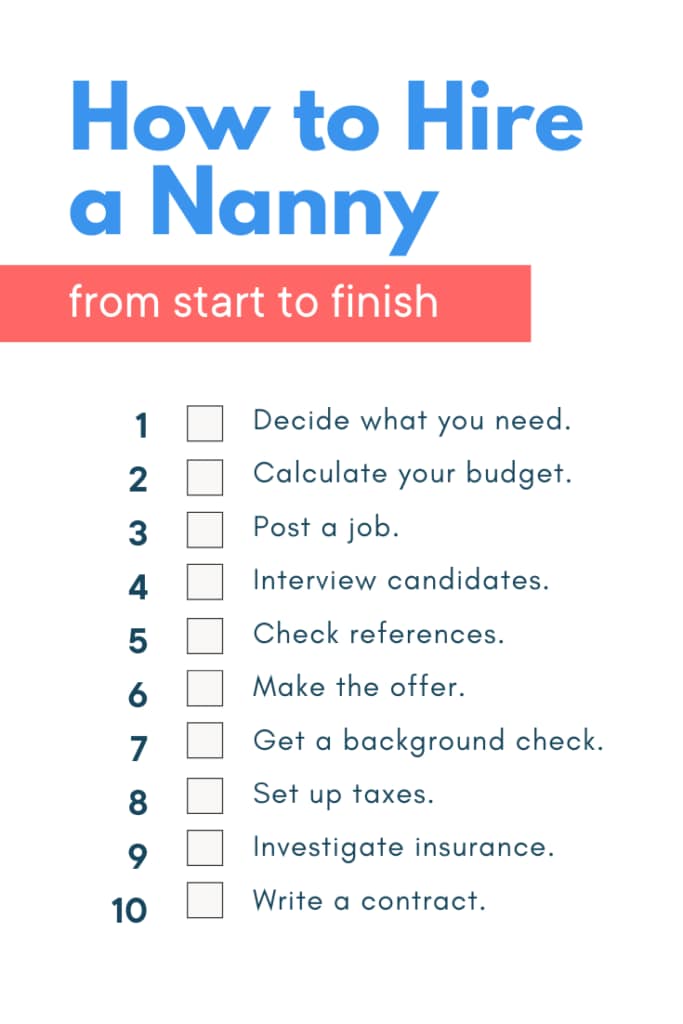

Here S How To Hire A Nanny From Start To Finish Care Com Resources

7 Steps For Filing Taxes As A Nanny Or Caregiver Care Com Homepay

Nanny Tax Pitfalls And Need To Knows For Your Taxes

Hiring A Nanny Tips On Handling Taxes And Other Costs Mybanktracker